From Barter to Bitcoin: Cryptocurrency

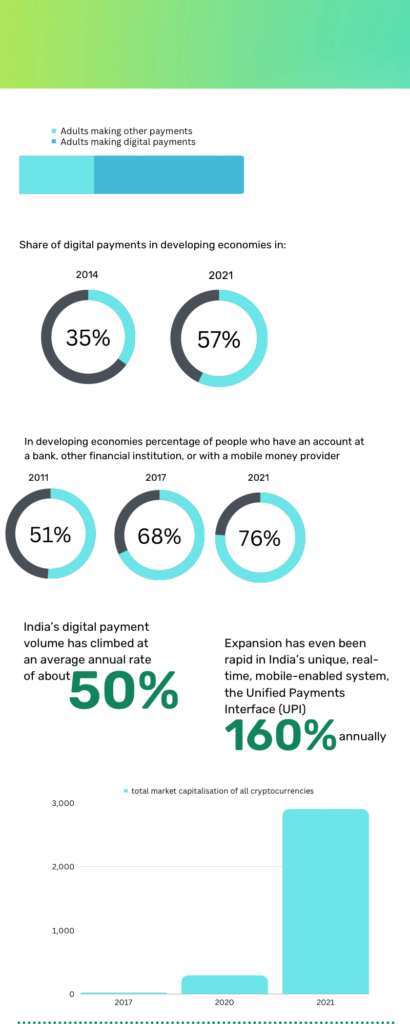

As we saw in the previous post, physical modes of payments, including cash and cheques, have disappeared from most transactions. There has been a massive expansion in digital payments, such as credit cards, in recent years. In today’s world, most people have an account in a bank or a mobile money provider. We obviously cannot ignore the invention of bitcoin and the rapid growth of cryptocurrency in the past decade.

The infographic on the right gives us a perspective on this growth

Have you ever wondered why people keep their hard earned money in the bank? Banking is just based on one thing: trust. Although banks have gained the trust of many and have taken several measures to ensure that money remains secure, the possibility of something going wrong still exists. As mentioned below, bank frauds in recent years have increased, causing people to lose faith in banks. Over the past few years, the cases of bank frauds have multiplied.

While the digital system is the easier option, in today’s interconnected world it is fragile like a house of cards. Imagine one technical glitch or a group of hackers committing cyberterrorism – or the events in Die Hard 4 happening in real life – and wiping out all the money that is digitised. That is how vulnerable the whole system is.

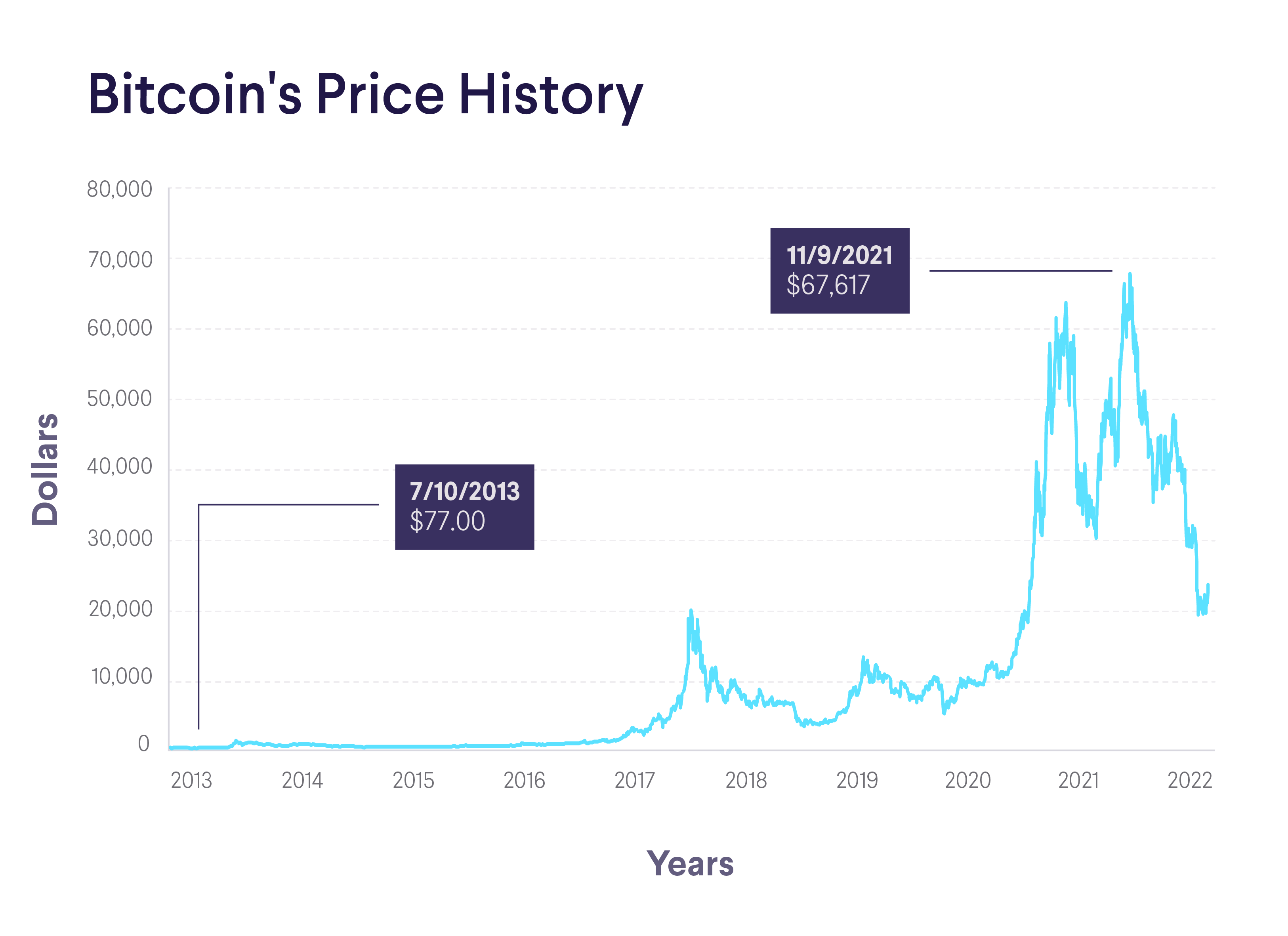

With the rise in bank frauds, the 2008 financial crisis and the proliferation of digital banking, the timing was perfect for a digital and decentralised currency to enter the financial landscape. In 2009, Satoshi Nakamoto made the first-ever Bitcoin (BTC) transaction, sending 10 BTCs to Hal Finney. Just like that a new asset class was born: cryptocurrency. Whether Nakamoto (we don’t even know if that’s his actual name) intended to address the issues with an alternative currency or come up with an innocuous invention, we’ll never know. But “Nothing is more powerful than an idea whose time has come.” – Victor Hugo. Cryptocurrency completely revolutionised the way we look at currencies.

Cryptocurrency is trustless, decentralised, secure and transparent. Imagine a currency that is completely digital. Cryptocurrency is just that. It’s a system which has stored money but is not controlled by central agencies such as banks and governments. It has all records of when the currency is sent or received, like a digital book, that can be accessed by anyone. It’s extremely difficult to steal cryptocurrency, making it safe to use. The first ever form of a decentralised currency was bitcoin. In 2010, the first bitcoin exchange came up. Since the invention of bitcoin, about 16000 different types of cryptocurrency have emerged which highlights how widespread digital money has become. Interestingly, there is a huge amount of about $300 billion in bitcoins. We can think of cryptocurrency, basically digital assets, as stocks that can be invested in, with their values fluctuating over time due to scarcity.

With more and more people still experimenting with crypto, even banks are taking an interest in cryptocurrency and are trying to adopt the same mechanism. In the changing times, banks are becoming crypto-friendly. While they remain traditional banks, they have expanded their services to include crypto. For instance, Deutsche Bank plans to provide a service through which investors can hold and trade cryptocurrencies. Some of the other crypto-friendly banks include JP Morgan Chase, Goldman Sachs, and Bank of New York Mellon. In India, the RBI is skeptical of cryptocurrency but they have introduced a digital rupee.

Although crypto may be the future of investments, the system is unpredictable and one should be cautious when putting their money into it. Money can multiply in value through cryptocurrency, but it can also be wiped out suddenly.

Pingback: how to prepare ginseng root for men

Pingback: how do i get cialis

Pingback: lilly cialis coupons

Pingback: viagra 25 mg sildenafil citrate

Pingback: 50mg generic viagra

Pingback: where to buy clomid

Pingback: rybelsus tablets