From Barter to Bitcoin – Part III : The rise and fall of the gold standard

“Money is not coins and banknotes. Money is anything that people are willing to use in order to systematically represent the value of other things for the purpose of exchanging goods and services.” Sapiens (2011) by Yuval Noah Harari

In my previous blog, I discussed how the barter system – despite its obvious merits – was not a sustainable option as trade became more complex. The system had to evolve to take into account more complex transactions and of course an increase in global trade. Hence the need for a controlled transaction system resulted in the emergence of money.

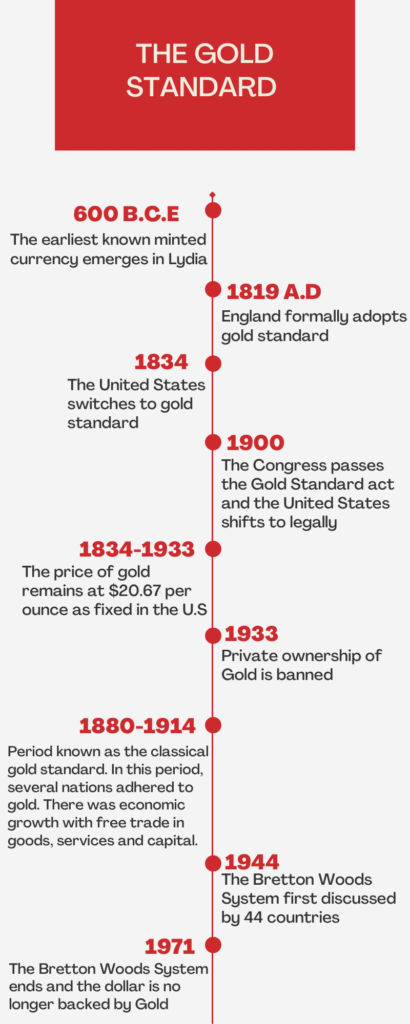

All the many versions of currency – whether it was cowrie shells or coins – had three major features in common: currency had to be physical, resilient and above all had to be agreed upon by all stakeholders. Currency underwent various changes over the years before it was ‘standardised’ to first be represented by gold coins (perhaps because gold is rare, malleable and resistant to corrosion) and eventually to ‘paper currency.’

The Greed of Goldsmiths

Marco Polo had introduced the concept of banknotes to Europe when he returned from China in the 13th century, but Europe was not ready for banknotes then. By the 17th century, however, Europe had caught on to the trend and goldsmiths adopted the practice of using notes as a security, backed by the gold that people had deposited with the goldsmiths. The paper IOU note became popular because of its convenience. People started transacting using the paper note, rather than, the more cumbersome, gold. These goldsmiths were the original banks. They saw that people preferred transacting in paper currency and based on the hypothesis that all the people will not come together asking for the gold, they started issuing more notes than the value of the gold that was held by them. This was the first expansion of money supply and was also the introduction of the Gold standard, a monetary system where a country’s currency or paper money has a value directly linked to gold.

The gold standard was introduced in an effort to fight inflation (Inflation refers to the rate of increase in prices over a period of time. In other words, the purchasing power of money goes down. Because of inflation, you can buy less for $1 today than what you could buy in the past. Anyways this is a vast topic that I’ll save for another blog). It did this by limiting the excessive issue of paper currency by governments or banks. By the 1930s, every dollar printed was backed by around USD 0.40 worth of Gold.

Knickerbocker Crisis

To meet the excessive, unprecedented demands for cash and to stabilize prices, the Federal Reserve System (FRS) was introduced in 1913. This system issued notes to banks. This, in turn, helped banks to issue notes when demand was higher. The system was introduced post ‘the Panic of 1907’ or the ‘knickerbocker crisis’ that refers to the panic induced run on the banks in mid-October 1907.

As World War 1 loomed, the US economy faced uncertainty, but the decade post World War saw a rapid growth of the US economy, which eventually led to the great depression (originating in the US, but cascading to the other countries’ economies). The stock market crash was severe, with even the blue chips falling by over 80% in 1929 from their peak price. In this panic, overwhelming cash withdrawals caused runs on the banks, leading to the entire banking system failing. This only served to expand the role of the FRS.

Gold Standard loses its shine

Unfortunately, the Federal Reserve system did not work as it was unable to meet the demand for cash, print more money or lower interest rates. Printing more money would devalue the dollar and lowering interest rates would force gold owners to sell the gold internationally, which would reduce the national supply of gold. Therefore, in 1933 the gold standard ended. In 1934, the Gold Reserve Act prohibited the private ownership of gold which removed gold from circulation and as a standard.

The rise of the Dollar and the demise of the gold standard

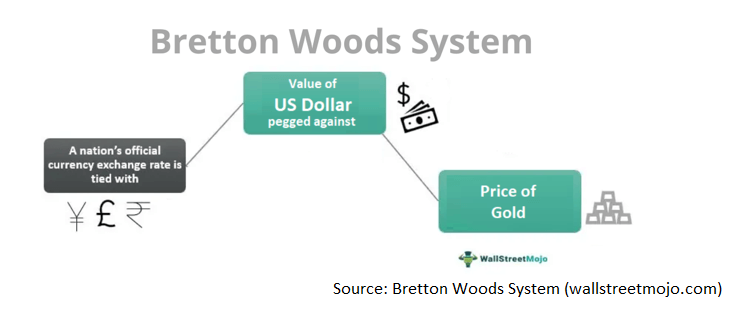

The Bretton Woods agreement was first discussed in 1944 by 44 countries. According to this system, currencies were pegged to the U.S dollar’s value. The United States’ economic dominance, having a major chunk of the world’s Gold, convinced all nations to peg their currency to the U.S Dollar. In turn, the U.S Dollar was pegged to $35 per ounce worth of gold. All countries who met at Bretton Wood had the main goal of improving the efficiency of the exchange system, preventing the devaluation of currency and promoting economic growth.

However, the agreement was short-lived. Various factors contributed to the end of the system. Firstly, it had flaws in its structure where the “fundamental disequilibrium”, a situation where countries can change their exchange rate, was not well defined. Secondly, since the system was linked to the dollar, which in turn was linked to gold, capital mobility was limited. As a result, the Bretton Woods system came to an end. In the 1970s, U.S president Richard Nixon said that the US would not exchange gold with currency, which was the final nail in the coffin for the Gold Standard.

Ironically though, people still tend to turn to gold at times of crisis. Remember how people suddenly became so interested in investing in Gold when COVID hit? Though the gold standard has been long gone, gold still remains a security blanket in times of crisis.